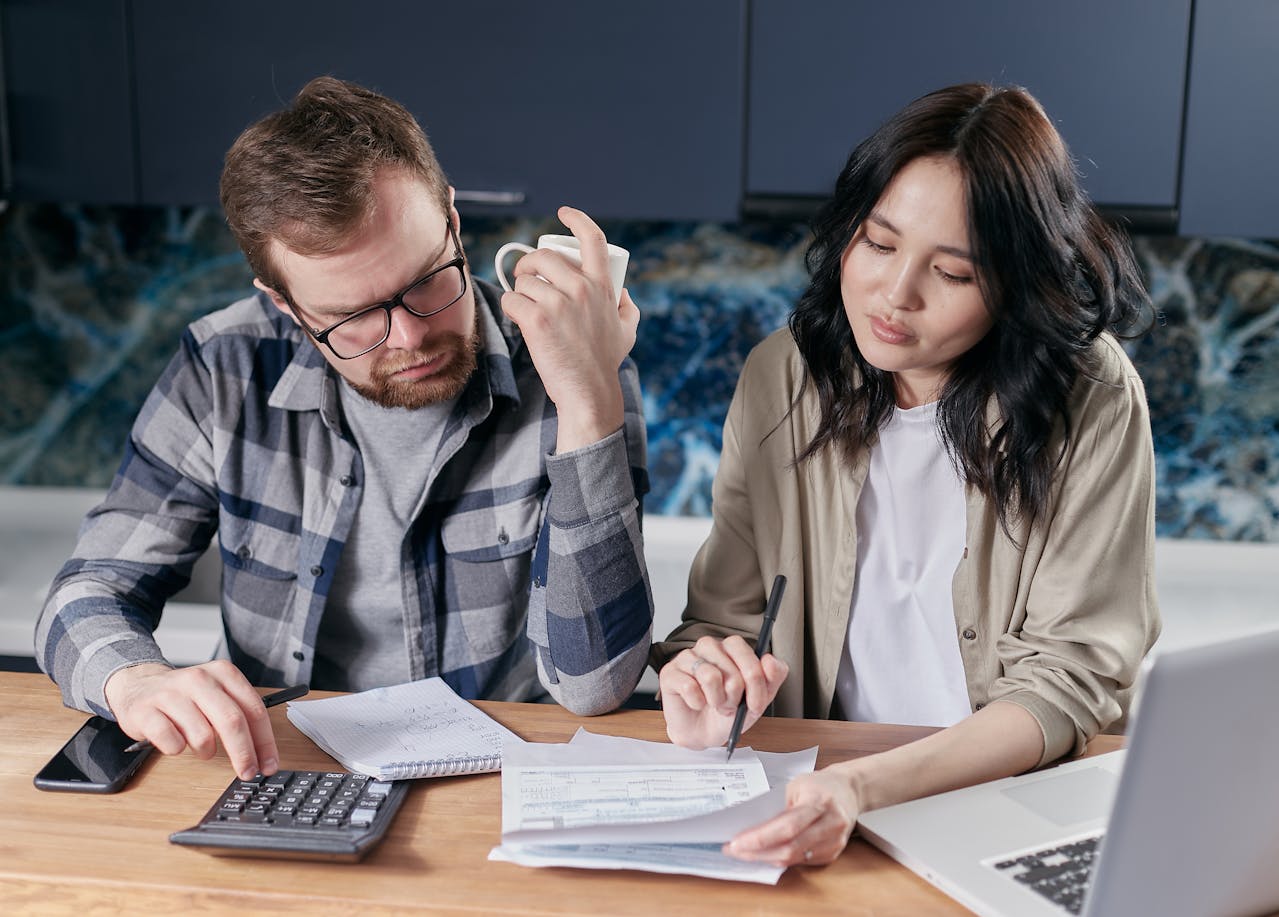

Understanding Credit Scores: Tips for Improving Your Credit and Borrowing Wisely

Your credit score is a crucial financial metric that impacts your ability to borrow money, secure favorable interest rates, and achieve important financial goals. Understanding how credit scores work and taking steps to improve and manage them wisely is essential for financial success. In this guide, we'll delve into the fundamentals of credit scores and provide actionable tips for improving your credit and borrowing responsibly.

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness, based on your credit history and financial behavior. It serves as a measure of risk for lenders and influences their decisions when approving loans, credit cards, or other forms of credit. Credit scores typically range from 300 to 850, with higher scores indicating lower credit risk.

Factors that Affect Your Credit Score

Several factors contribute to your credit score, including payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. Understanding these factors can help you identify areas for improvement and take proactive steps to manage your credit responsibly.

Tips for Improving Your Credit Score

Pay bills on time: Timely payment of bills is one of the most important factors affecting your credit score. Set up automatic payments or reminders to ensure you never miss a payment.

Reduce credit card balances: Aim to keep your credit card balances low relative to your credit limits. High credit utilization can negatively impact your credit score.

Avoid opening too many new accounts: Opening multiple new credit accounts within a short period can signal risk to lenders and lower your credit score.

Maintain a diverse credit mix: Having a mix of credit accounts, such as credit cards, installment loans, and mortgages, can positively impact your credit score.

Regularly check your credit report: Monitor your credit report for errors or inaccuracies that could negatively impact your credit score. Report any discrepancies to the credit bureaus and dispute them promptly.

Borrowing Wisely

Borrow only what you can afford to repay: Before taking on debt, carefully consider your financial situation and ability to repay. Avoid borrowing more than you need or can comfortably afford.

Shop around for the best rates: Compare offers from multiple lenders to find the most favorable terms and interest rates. A lower interest rate can save you money over the life of the loan.

Read and understand the terms and conditions: Before signing any loan agreement or credit contract, review the terms and conditions carefully. Pay attention to interest rates, fees, repayment terms, and any penalties for late payments or early repayment.

Maintaining Good Financial Habits

Establish a budget: Create a budget to track your income and expenses and ensure you're living within your means. Allocate funds for savings, debt repayment, and discretionary spending.

Build an emergency fund: Save money in an emergency fund to cover unexpected expenses or financial setbacks without resorting to borrowing.

Monitor your credit regularly: Keep a close eye on your credit score and credit report to track your progress and detect any changes or issues early on. Many financial institutions offer free credit monitoring services to their customers.

Understanding credit scores and adopting responsible borrowing habits are essential components of financial literacy and empowerment. By taking proactive steps to improve your credit score, borrowing wisely, and maintaining good financial habits, you can build a solid foundation for a secure financial future and achieve your long-term goals. Remember that improving your credit score takes time and patience, but the rewards of financial stability and freedom are well worth the effort.